Installs

5,000,000+

Price

Free

Developers

Albert - Budgeting & Banking

Content Rating

Everyone

Android Version

7.0

Version

10.0.18

Albert: Budgeting and Banking APP Review

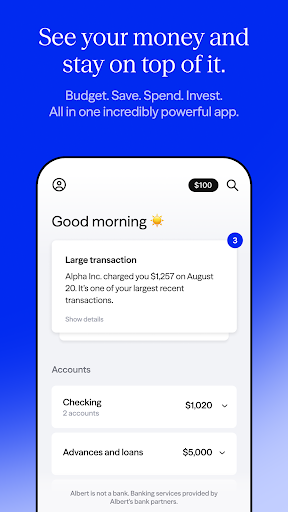

Introducing Albert: Your All-In-One Money App

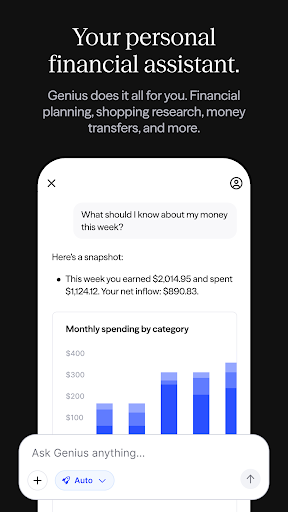

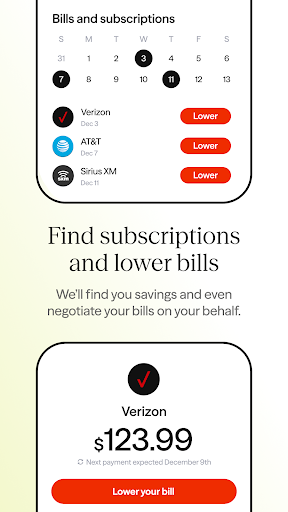

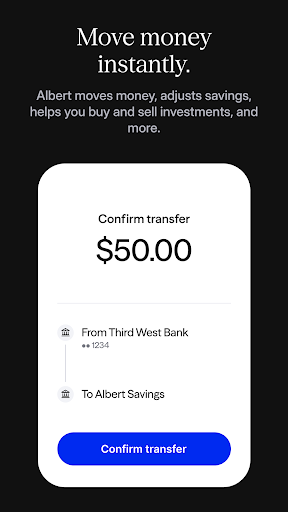

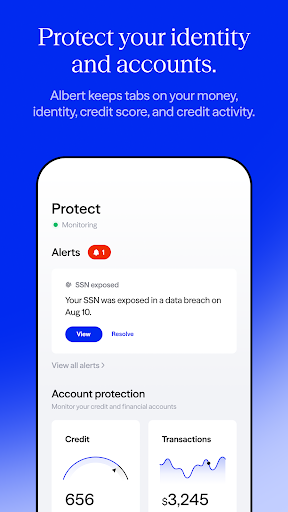

If you're looking for a powerful personal finance tool, Albert might just be the perfect solution for you. Combining budgeting, saving, spending, and investing features, this app provides a comprehensive approach to managing your money. Plus, you can enjoy 24/7 identity monitoring and use the app's built-in AI, Albert Genius, to get financial advice whenever you need it.

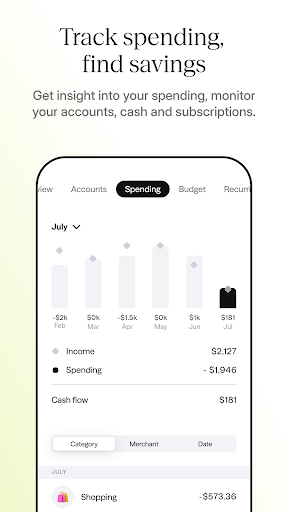

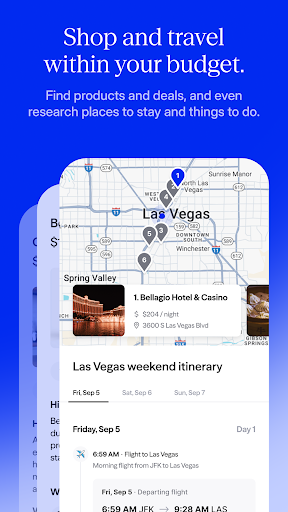

Features That Stand Out

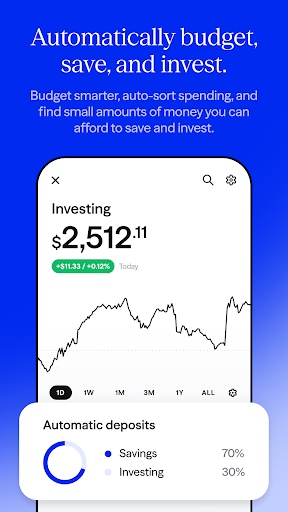

Albert excels with its online banking options, allowing users to receive direct deposits up to two days early and earn cashback from select stores. Its budgeting tool is designed to help you create and manage spending plans effortlessly, while the automatic saving and investing features allow for hands-free financial growth. The highlighted high-yield savings account offers impressive returns, substantially higher than the national average, making it an attractive option for savers.

Safety and Convenience

The app prioritizes security with 24/7 monitoring of your accounts and provides alerts in real-time to help you catch potential fraud. Although the app does include a subscription fee ranging from $14.99 to $39.99, many users find this worth the trade-off for the extensive features and support available. However, it's also crucial to be aware of possible complications associated with canceling subscriptions and account management.

Conclusion

In summary, while Albert is a feature-rich app with exciting benefits for managing your finances, potential users should weigh its pros and cons carefully. It’s ideal for anyone seeking an all-in-one financial tool, but the subscription model and complexity of canceling accounts might deter some. Overall, if you commit to learning its ins and outs, it can become a valuable ally in your financial journey.

User Reviews from Google Play Store

Leah (Le'ah)

Jan 22, 2026Listen to the bad reviews. It's bad for a reason. edit: I just tried again 5 years later in 2026 and its still just as bad. they didn't even approve me for a $1000 loan. I make over $1000 a week and was trying to get a loan to build credit. they denied the loan and offered a $25 cash advance 😂😂😂 $25 is barely even one meal and I dont even need the money. I just wanted to see what the app would do and its absolutely trash!

Developer Response

Hi there — Among our products, we offer on-demand access to a team of financial experts, debit card with cash back rewards, instant advances, investing, and more. Please text us at 639-37 with any questions — we'd love to make Albert work for you.

Genia Brown

Jan 22, 2026deducted a transaction out of my account. I never authorize any fees to come out from Albert. I closed my account permanently

Version: 10.0.30

Danny Barcomb

Jan 22, 2026i have been trying to close my account for a year now. no help from customer service, texts go unanswered, can't even login anymore. worst ever and 20.00/month being wasted.

Cristian Garcia

Jan 22, 2026terrible

Version: 7.13.5

Kristy Sluder

Jan 22, 2026terrible after following all requirements I got zero help. I'm disgusted.

Pros

Cons

Comments

Similar Apps

CRED: UPI, Credit Cards, Bills

Finance

4.8

Freebie Invoice Maker Simple

Finance

4.7

Rocco - Fast Cash Advance

Finance

3.5

SoLo Funds: Lend & Borrow

Finance

4.2

Grid Money

Finance

3.9

DailyPay On-Demand Pay

Finance

4.7

Gerald - Cash Advance

Finance

4.1

Rocket Mortgage

Finance

4.8

Rocket

Finance

3.9

Trading 212: Stocks, ETFs, ISA

Finance

4.4

HDFC SKY: Stocks Demat IPO MF

Finance

4.2

Stock Events Market Tracker

Finance

4.7

moomoo: Investing & Trading

Finance

4.6

INDmoney: NRI Investment App

Finance

4.7

Trending Apps

Jily -Match to video chat

Social

4.7

CARFAX Car Care App

Auto & Vehicles

4.7

AutoScout24: Automobile market

Auto & Vehicles

4.6

CARFAX - New & Used Cars

Auto & Vehicles

4.6

Device Clone

Productivity

4.0

Android Device Policy

Tools

3.1

Device Care

Tools

3.9

Squadnox - Game Server Hosting

Tools

2.5

SuperToons Masha and the Bear

Entertainment

4.5

Apples & Bananas Kids App

Education

3.4

Codecademy Go

Education

4.7

Learn Python-Code Lab by Ocean

Education

4.2

Hyperskill: Learn to code

Education

4.8

Code Life - Learn to code

Education

4.4

Encode: Learn to Code

Education

4.5

Learn Python

Education

4.8

Business Marketing Auto Reply

Communication

4.4

WooCommerce

Business

4.6

Glitchy Digital Marketing

Social

4.6

Learn Growth Hacking

Education

4.7